- Bitcoin's past performance suggests the asset class is less like gold and more like stocks.

- In prior stock market corrections, bitcoin plummeted while gold served as an effective hedge.

- "The correlation between bitcoin and high-growth benchmark ARKK still stands at ~60% year-to-date," Fairlead's Katie Stockton said in a Friday note.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

While bitcoin is often described as an alternative to gold, its historical price action suggests it's more closely related to stocks.

Investors have flocked to the cryptocurrency sector with the objective of gaining exposure to returns that are uncorrelated to traditional asset classes like stocks, bonds, and precious metals, as well as hedging against rising inflation.

But two charts depicting relative performance amid recent stock market corrections illustrate that bitcoin is more positively correlated to equities than some might think.

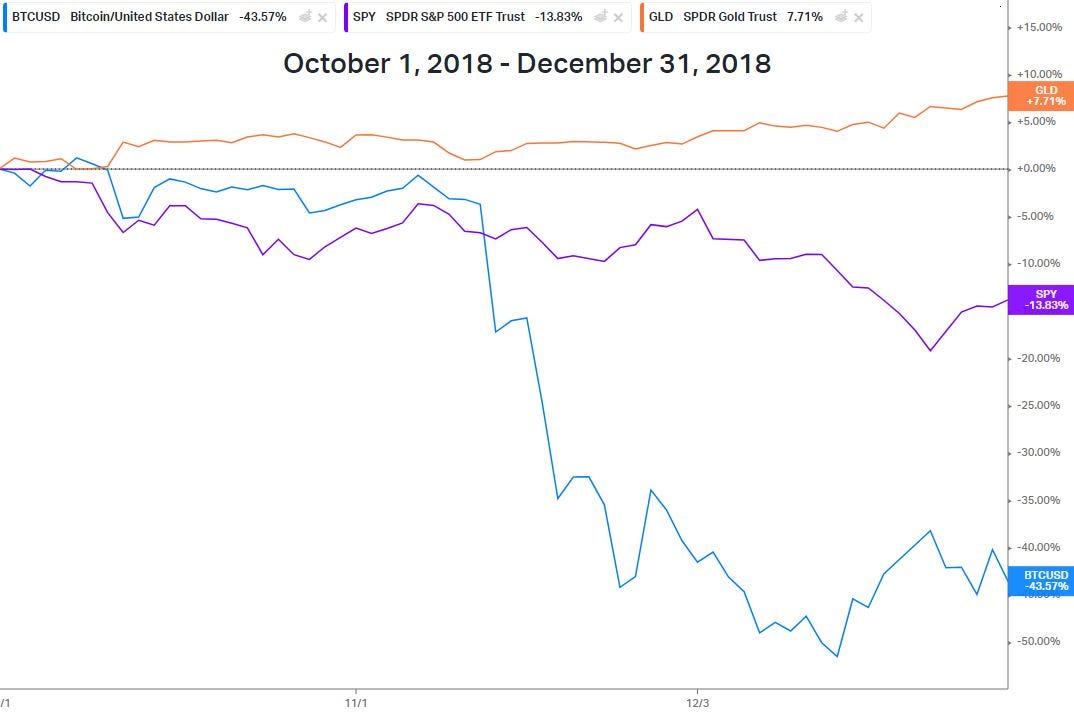

The first one shows that when stocks fell nearly 20% in the fourth quarter of 2018, bitcoin fell as much as 50%, while gold traded up nearly 8%. The market volatility was sparked by a hawkish Federal Reserve and concerns of slowing economic growth due to trade tariffs.

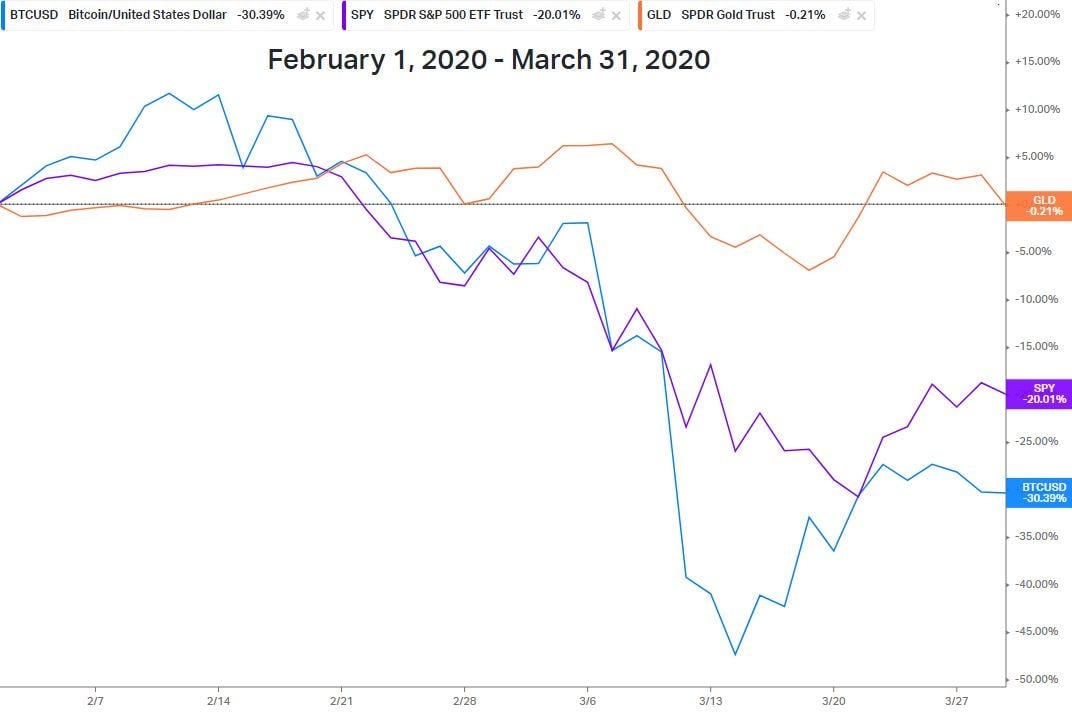

The second one fast forwards to the onset of the COVID-19 pandemic in early 2020, when bitcoin again fell almost 50% while stocks fell as much as 34%. Amid the risk-off carnage, gold traded flat, once again proving its standing as a safe-haven asset.

Today, amid a nearly 7% decline in the S&P 500 since the start of 2022, bitcoin is down 17% while gold is flat. The data is clear that for now, bitcoin is less of a hedge against inflation, and is instead a volatile risk-on asset that does well when stocks do well, and vice versa.

Technical analyst Katie Stockton of Fairlead Strategies highlighted this fact in a note on Friday.

"The correlation between bitcoin and high-growth benchmark ARKK still stands at ~60% year-to-date, versus ~14% for the price of gold, reminding us to categorize bitcoin and altcoins as risk assets rather than safe havens," she said.

One reason gold acts as a reliable safe haven amid market turmoil is that it has a history spanning thousands of years of holding some form of value. Meanwhile, bitcoin just celebrated its 13th birthday.

When it comes to evidence-based investing, investors value more data than less, and gold has the data to back up its standing as a safe-haven asset, whereas bitcoin does not.